MEXC 2024 Review: Scam or Safe Exchange?

In the stormy sea of cryptocurrency exchanges, MEXC has positioned itself as a reliable and multifunctional island offering traders of all levels a wide range of tools and services.

In this article, we will analyze the MEXC in depth by evaluating:

- Trading capabilities: spot, margin, futures and contract trading, staking and more.

- Security level: user protection measures, security history of the exchange.

- Commissions: commission structure, comparison with competitors.

- Interface: usability, navigation, accessibility on different devices.

- Support service: quality and promptness of work.

At the end of the article, we will summarize the main advantages and disadvantages of MEXC and answer the main questions:

- Is MEXC Global a trustworthy exchange?

- What are the pros and cons of the MEXC exchange?

- Can we trust the MEXC Global exchange with our money?

Important: MEXC is not available for use in the US. For use in the US, check out : Top 10 Decentralized Exchanges in 2024

Join us in this study to find out if MEXC is your ticket to success in the world of cryptocurrencies!

MEXC: What's the exchange?

MEXC is a centralized exchange born in 2018 in the beautiful expanse of Seychelles in East Africa. In recent years, it has gained attention thanks to its attractive operations, favorable trading conditions (up to aggressive marketing solutions: 0% trading commissions), attracting experts from the world's most prestigious enterprises and financial institutions with extensive experience in blockchain and finance.

MEXC acts as an exchange platform for more than 2,000 coins in 2,400 trading pairs, with a daily trading volume of up to $1.5 billion as of this writing.

Sign Up for MEXC and trade with 0% commissions!

Spot and margin trading

The ability to trade spot or margin all coins on the exchange opens up endless possibilities for users. New coins and projects are regularly added here, among which you will find not only the popular DeFi and NFT coins, but also innovative projects that are not available elsewhere. In fact, MEXC is one of the first exchanges where many popular tokens appear and are listed before all others, which emphasizes its leading role in the innovative environment of the cryptocurrency market and its focus on results and motivation to stay ahead of the competition.

Comparison of margin and spot trading:

| Criterion | Margin trading | Spot Trading |

| Use of borrowed funds | Yes | No |

| Leverage | Up to 200х | 1х |

| Potential profit | Above | Below |

| Risks | Above | Below |

| Loan fee | Yes | No |

| Complexity | Above | Below |

| Available assets | Wide selection | Limited selection |

| Suitable for | Experienced traders | Beginners and experienced traders |

Additional distinctions:

- Margin trading allows you to short assets by betting on the price going down. Spot trading allows you to only buy assets.

- Margin trading can be more profitable in volatile markets. However, it can also lead to large losses.

- Spot trading is a simpler and less risky type of trading.

Margin trading can be more profitable than spot trading, but it is also more risky. It is important to thoroughly familiarize yourself with the risks of margin trading before you start trading.

It is recommended to start with spot trading and then move to margin trading when you are ready for higher risks.

Contract trading: open-ended opportunities

MEXC offers trading in open-ended contracts, below we will understand its essence and features:

What is the difference between them and traditional futures?

- Indefinite: There is no expiration date, you can hold a position for as long as you like.

- Flexibility: There is no time limit for opening and closing a position.

- Stability: The funding mechanism keeps the contract price close to the price of the underlying asset.

How does it work?

Imagine you have bought a perpetual contract on Bitcoin. Every 8 hours, the funding rate is calculated. If the rate is positive, you, as the buyer, will pay the seller. If the rate is negative, the seller will pay you.

Why is this necessary?

The funding mechanism guarantees that the contract price will be as close as possible to the price of the underlying asset. This makes open-ended contracts an attractive instrument for risk hedging and speculation.

Perpetual contracts are:

- Accessibility: Trade cryptocurrency without having it on your balance.

- Efficiency: Use leverage to maximize your profits.

- Versatility: Suitable for both hedging and speculation.

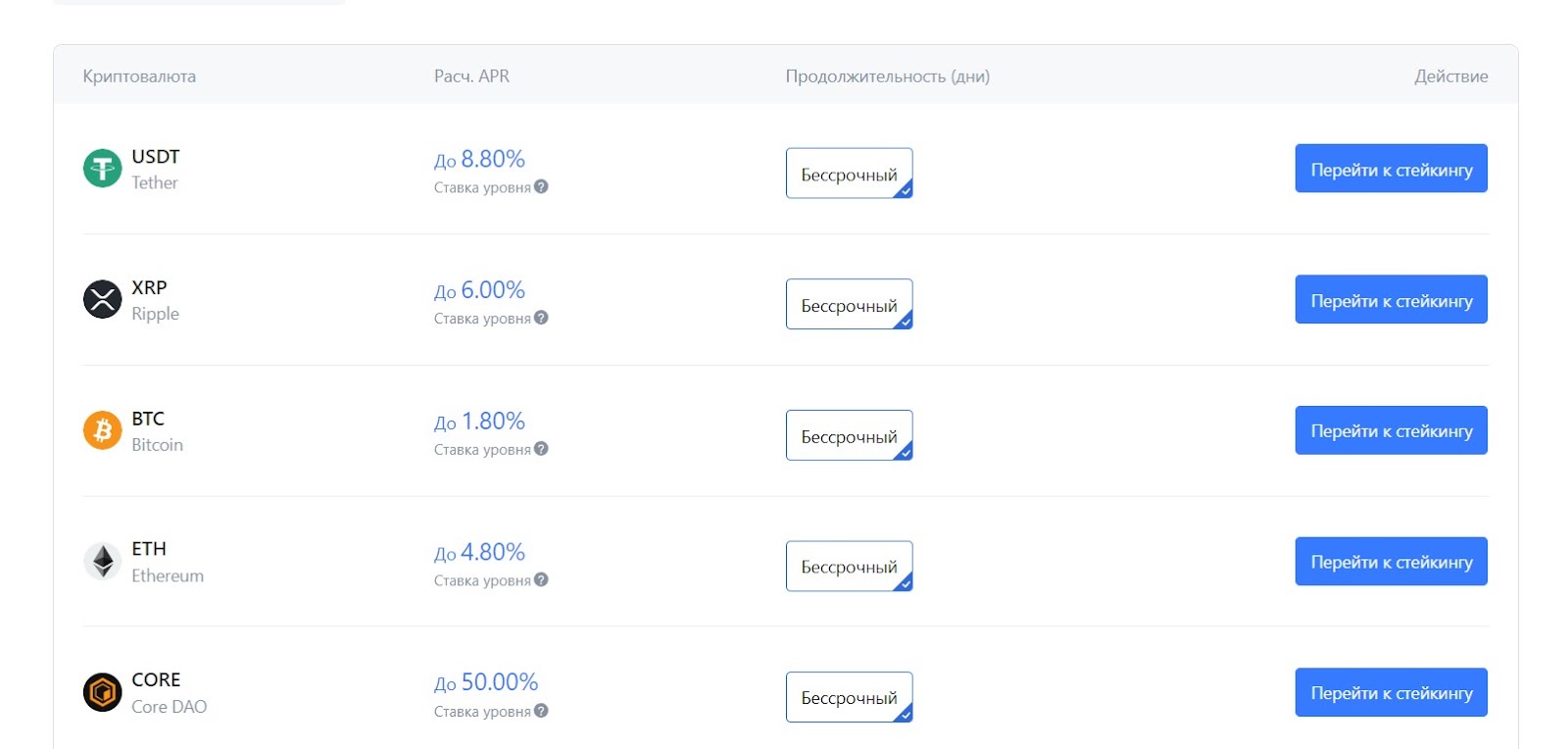

Staking on MEXC

Want to earn passive income from your cryptocurrencies?

MEXC Staking is a simple and effective way to do this.

How does it work?

Benefits of staking on MEXC:

- Simplicity: No need for complicated equipment or technical knowledge.

- Profitability: Get stable passive income from your cryptocurrencies.

- Flexible: You can deposit and withdraw tokens at any time.

- Security: MEXC is a reliable platform with multiple layers of security.

Advantages of using the MEXC exchange

- User-friendly interface: MEXC has an interactive interface that is suitable for both experienced traders and beginners. You can choose from light or dark design themes to make your work on the exchange as comfortable as possible.

- Mobile App: MEXC is always at your fingertips. With the mobile app for Android and iOS, you can trade, monitor cryptocurrency rates, make deposits and withdrawals wherever you are.

- Response to user feedback: MEXC is constantly being developed and improved. The development team closely monitors user feedback and promptly responds to user requests.

- MX DeFi: MEXC offers a unique trading proposition - MX DeFi. It is a platform that allows you to generate passive income from your cryptocurrencies. You can participate in steaking, liquidity pools and other DeFi products.

- User education: MEXC cares about its users. On the exchange's website, you will find a lot of tutorials to help you understand how to work with cryptocurrencies and trade on the exchange.

- Community and social media presence: MEXC is actively developing its community. You can find the exchange on Twitter, Telegram, Facebook and other social networks.

Safety and compliance with MEXC regulations

In light of the strict scrutiny of cryptocurrency exchanges by regulators around the world, MEXC has taken additional measures to ensure that its platform is as secure as possible:

- State-of-the-art security risk control system: MEXC uses advanced technology to protect the funds of its users.

- DDOS protection system: MEXC is protected from DDoS attacks, which guarantees uninterrupted operation of the exchange.

- Multi-signature: All MEXC transactions require confirmation from multiple devices.

- Autonomous Signature: MEXC uses autonomous signature to protect its cold wallets.

- Layered architecture: MEXC uses a layered architecture to protect its systems.

- Cold Storage: 99% of MEXC's assets are stored in cold wallets to ensure maximum security.

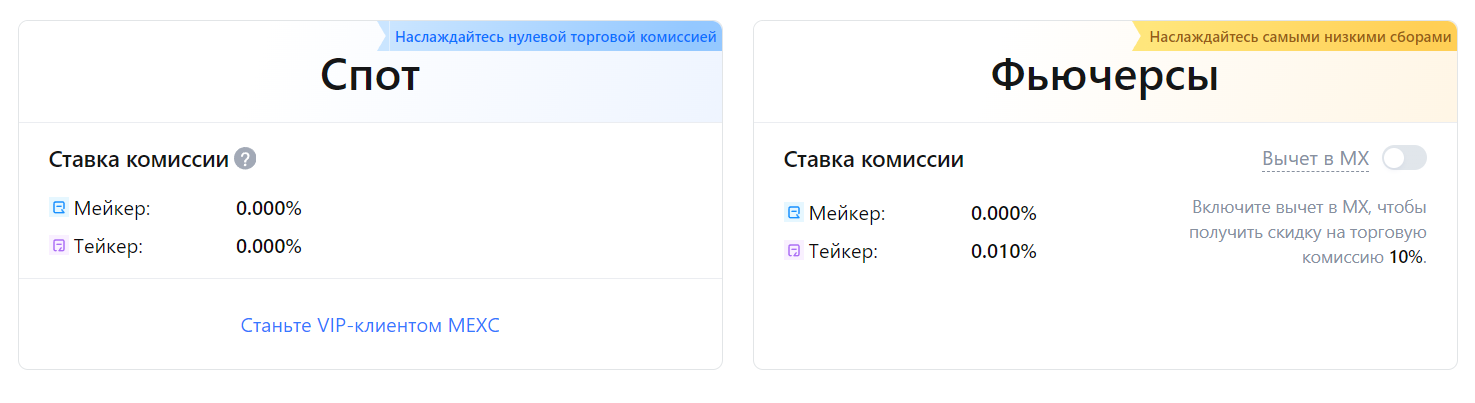

Commissions and fees at MEXC

MEXC has launched the lowest commission in the market: Zero spot trading commission, Zero Futures Maker's commission and 0.01% Futures Taker's commission (31.01.2024).

In appreciation for the continued support of users, MEXC is introducing a new fee effective January 31, 2024:

- Spot trading: 0%

- Futures trading:

- Maker: 0%

- Taker: 0,01%

MEXC offers the lowest trading commissions on the market!

Details:

- Spot trading:

- All trading pairs on MEXC will have zero commission.

- The fee for converting small assets to MX remains unchanged.

- Futures trading:

- All futures trading pairs on MEXC will have a zero Maker commission and a 0.01% Taker commission.

- Users can get a 10% discount on futures commission by utilizing the MX deduction feature.

WARNING: Commissions may be revised, and, of course, this move is marketing to attract new clients of the exchange. Also, do not forget that exchanges have commissions for deposit/withdrawal, the commission percentage is calculated individually for each cryptocurrency. You can familiarize yourself in the appropriate section of the exchange.

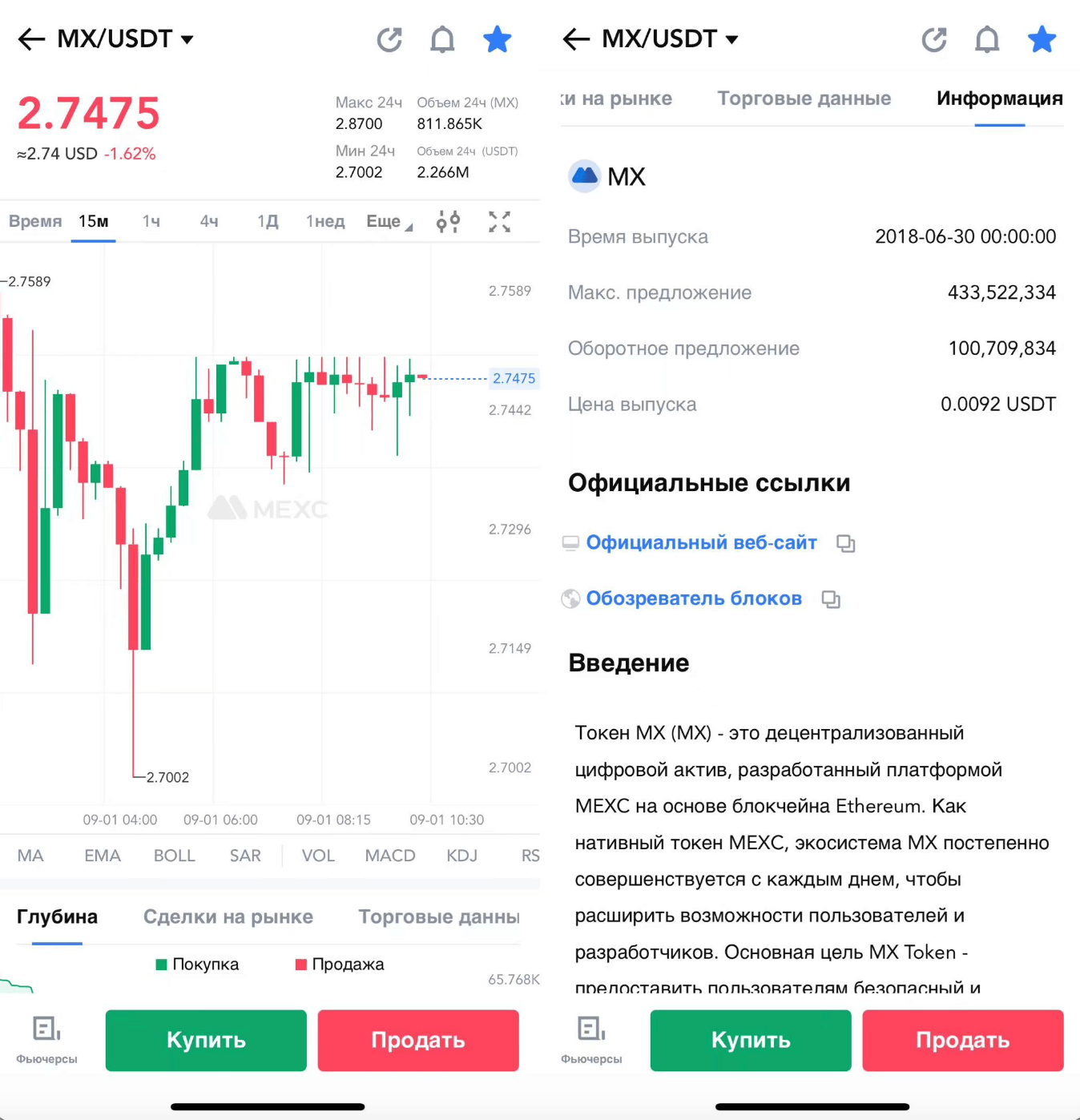

MX token: the heart of the MEXC ecosystem

The MX token is a native digital asset of the MEXC exchange. It plays an important role in the expansion and development of the MEXC ecosystem:

The benefits of owning an MX token:

- Discounts on trading commissions: MX holders receive substantial discounts on trading commissions in the spot and futures markets. The more MX you hold, the greater the discount.

- Participation and Voting Rights: MX token gives its holders the right to participate in important processes and make decisions in Launchpad projects, Kickstater projects, M-Day, and new cryptocurrency listings.

- Access to exclusive offers: MX owners can get early access to new MEXC listings and products.

- Staking and DeFi Rewards: You can earn income by listing (staking) your MX tokens on an exchange or participating in MX DeFi products.

Token burning mechanism

MEXC buys back and burns MX tokens from the secondary market on a quarterly basis, using 40% of its profits. Thus, MX becomes increasingly scarce over time. This supports the token price and benefits holders in the long run.

MEXC Affiliate Program

MEXC offers an affiliate program that allows you to earn rewards for referring new users to the exchange.

Benefits of participating in the MEXC partner program:

- High commission: Up to 60% of the trading commissions of your referred users.

- Tiered system: Get additional rewards for referring other affiliates.

- Fixed income: Your referrals will bring you passive income for as long as they trade on MEXC.

- Transparent system: You can track your statistics and rewards in real time.

- Marketing Materials: MEXC provides you with all the necessary marketing materials to promote the exchange.

MEXC Exchange Reviews

You can find both positive and negative reviews of the exchange online and in the public domain. We cannot vouch for the reliability of each of them, as many companies allocate significant funds to whiten their reputation and remove reviews.

In general, based on the practice of other users and ours, MEXC has not been seen in any large-scale scams, and has not been involved in any high-profile scandals.

Conclusion

MEXC offers a wide range of services and innovative products for cryptocurrency trading, providing convenience and security to users and the lowest commissions in the market. However, the lack of licensing or regulation may increase risk for investors. It is recommended to conduct additional research and assess potential risks before using the platform.

Sign Up for MEXC and trade with 0% commissions!

Does MEXC have a license and is it regulated?

MEXC is a cryptocurrency exchange registered in Seychelles.

MEXC is currently unlicensed and not regulated by any financial authority.

However, the MEXC exchange is taking steps to increase its transparency and accountability:

- Proof of Reserves audit: MEXC regularly publishes reserve reports, confirming that it owns the assets of its users.

- Complies with KYC/AML: MEXC requires users to undergo KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures to ensure security and prevent illegal activities.

- Working together with regulators: MEXC says it is committed to working with regulators around the world.

It's important to note:

- Lack of license and regulation: MEXC is not licensed or regulated by any financial authority. This may pose a risk to users as the exchange is not accountable to any external bodies.

- Seychelles: Seychelles is not a highly regulated jurisdiction for cryptocurrencies.

Can I use MEXC in the USA?

MEXC is not available for users from the USA. The Exchange is not licensed or registered in any US state.

Can I use MEXC in the UK?

Yes, you can use MEXC in the UK. MEXC is available for UK users but is not licensed by the FCA.

Can I use MEXC in Ukraine?

Available: MEXC is available for users from Ukraine.

License: MEXC is not licensed by Ukrainian regulators.

Can I use MEXC in Russia?

Available: MEXC is available for users from Russia.

License: MEXC is not licensed by Russian regulators.

Use of MEXC in Russia may be restricted due to sanctions.

Can I use MEXC in Canada?

MEXC is not currently available to users from Canada. MEXC prohibits access from Canadian IP addresses. ade?

MEXC Scam or not?

There is no evidence to claim that MEXC is a scam. However, it is important to remember that investing in cryptocurrency exchanges is always risky and it is recommended to do thorough research and only use licensed and regulated platforms.

Does MEXC require KYC?

Yes, MEXC requires KYC (Know Your Customer) for all users if you need to withdraw more funds than set for accounts without KYC.