10 Best Decentralized Exchanges (DEXs) For 2024

Decentralized exchanges (DEXs) are a type of cryptocurrency exchange that is not controlled by a single central authority. Instead, they use smart contracts to facilitate trading between users. DEXs offer a number of advantages over centralized exchanges, including:

- Non-custodial: Users retain control of their private keys and funds at all times.

- Low fees: DEXs typically have lower fees than centralized exchanges.

- Wide range of assets: DEXs offer a wide range of assets to trade, including popular cryptocurrencies, altcoins, and stablecoins.

- Decentralized governance: DEXs are governed by their communities, which gives users a say in how the exchanges are run.

Best Decentralized Exchanges

In this section, we will review the best decentralized exchanges based on factors such as popularity, trading volume, liquidity, and security.

Parameters for Comparison

We will compare DEXs based on the following parameters:

- Blockchain: On which blockchain does the exchange operate?

- Type of exchange: What technology is used to exchange assets?

- Trading pairs: What trading pairs are available on the exchange?

- Features and capabilities: What features and capabilities does the exchange offer?

- Security: What security measures does the exchange use?

- Fees: What fees does the exchange charge?

| DEX's Name | Blockchain based | Trading Fees | Trading Pairs |

| Uniswap | Ethereum | 0.3% | 200+ |

| SushiSwap | Ethereum | 0.3% | 200+ |

| PancakeSwap | Binance Smart Chain | 0.2% | 100+ |

| Curve | Ethereum | 0.04% | 30+ |

| dYdX | Ethereum | 0.04% to 0.2% | 200+ |

| 1inch | Ethereum, Binance Smart Chain, Polygon, Optimism, Arbitrum | Variable | 1000+ |

| Balancer | Ethereum | 0.03% to 0.3% | 200+ |

| KyberSwap | Ethereum, Polygon, Avalanche, Fantom | 0.3% | 100+ |

| Quickswap | Polygon | 0.3% | 100+ |

| Raydium | Solana | 0.025% | 100+ |

Uniswap

- Blockchain: Ethereum

- Type of exchange: AMM

- Trading pairs: 200+

- Features and capabilities: Margin trading

- Security: Smart contract approval

- Fees: 0.3%

Uniswap is the most popular decentralized exchange. It is an AMM-based exchange that uses a liquidity pool to facilitate trading. Uniswap offers a wide range of trading pairs and low fees.

SushiSwap

- Blockchain: Ethereum

- Type of exchange: AMM

- Trading pairs: 200+

- Features and capabilities: Margin trading, yield farming, staking

- Security: Smart contract approval

- Fees: 0.25%

SushiSwap is a fork of Uniswap that offers a variety of features that are not available on Uniswap, such as yield farming and staking. SushiSwap also offers lower fees than Uniswap.

PancakeSwap

- Blockchain: Binance Smart Chain

- Type of exchange: AMM

- Trading pairs: 100+

- Features and capabilities: Margin trading

- Security: Smart contract approval

- Fees: 0.2%

PancakeSwap is a decentralized exchange that runs on the Binance Smart Chain. It is an AMM-based exchange that offers a wide range of trading pairs and low fees.

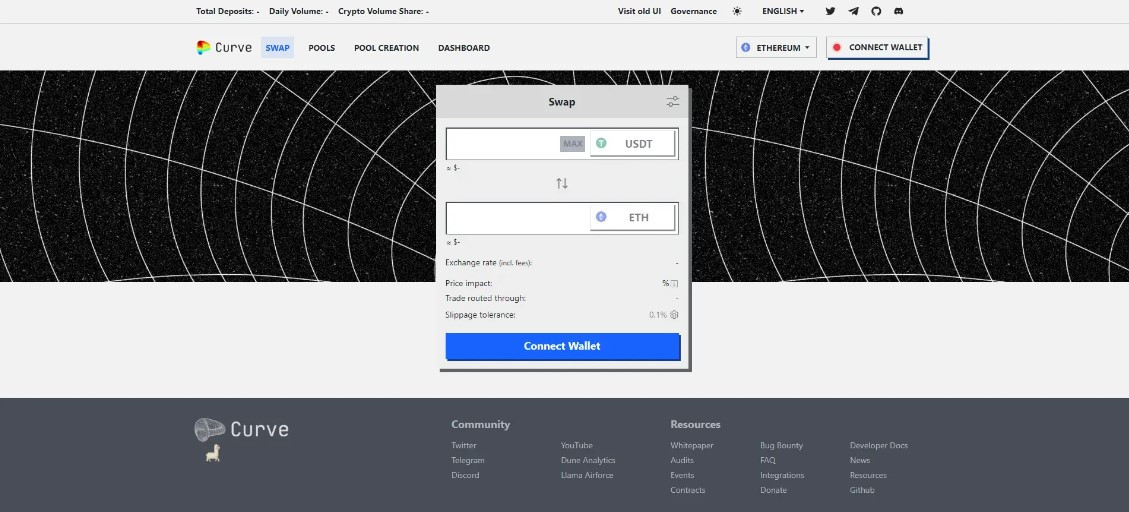

Curve

- Block chain: Ethereum

- Type of exchange: AMM

- Trading pairs: 30+

- Features and capabilities: Low fees

- Security: Smart contract approval

- Fees: 0.04%

Curve is a decentralized exchange that is optimized for stablecoin trading. It offers very low fees and high liquidity for stablecoin pairs.

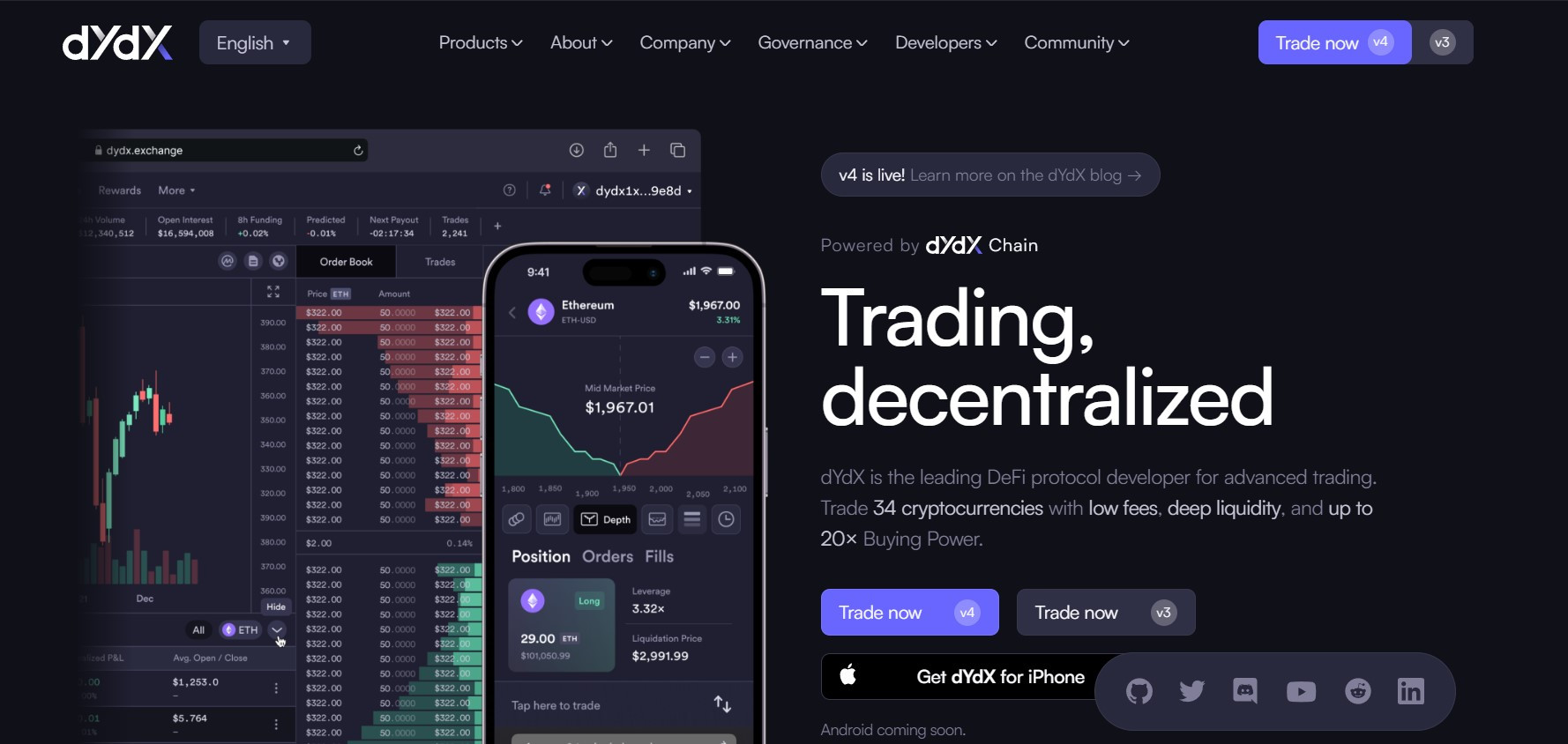

dYdX

- Block chain: Ethereum

- Type of exchange: AMM

- Trading pairs: 200+

- Features and capabilities: Margin trading, perpetual contracts

- Security: Smart contract approval

- Fees: 0.04% to 0.2%

dYdX is a decentralized exchange that offers margin trading and perpetual contracts. It is known for its high leverage options and deep liquidity.

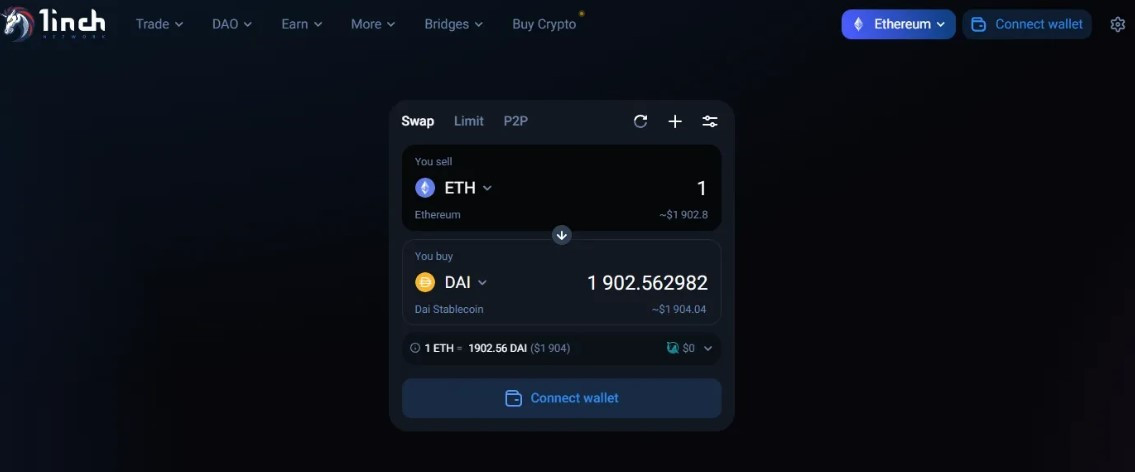

1inch

- Block chain: Ethereum, Binance Smart Chain, Polygon, Optimism, Arbitrum

- Type of exchange: Aggregator

- Trading pairs: 1000+

- Features and capabilities: Finds the best prices for trades across multiple DEXs

- Security: Smart contract approval

- Fees: 0.3% to 0.5%

1inch is a decentralized exchange aggregator that finds the best prices for trades across multiple DEXs. It is a good option for users who want to get the best possible price for their trades.

Balancer

- Block chain: Ethereum

- Type of exchange: AMM

- Trading pairs: 200+

- Features and capabilities: Custom trading pools

- Security: Smart contract approval

- Fees: 0.03% to 0.3%

Balancer is a decentralized exchange that allows users to create their own custom trading pools. It is a good option for users who want to trade assets that are not available on other DEXs.

KyberSwap

- Block chain: Ethereum, Polygon, Avalanche, Fantom

- Type of exchange: AMM

- Trading pairs: 100+

- Features and capabilities: Instant token swaps with no gas fees

- Security: Smart contract approval

- Fees: 0.3%

KyberSwap is a decentralized exchange that offers instant token swaps with no gas fees. It is a good option for users who want to make quick trades without having to pay high gas fees.

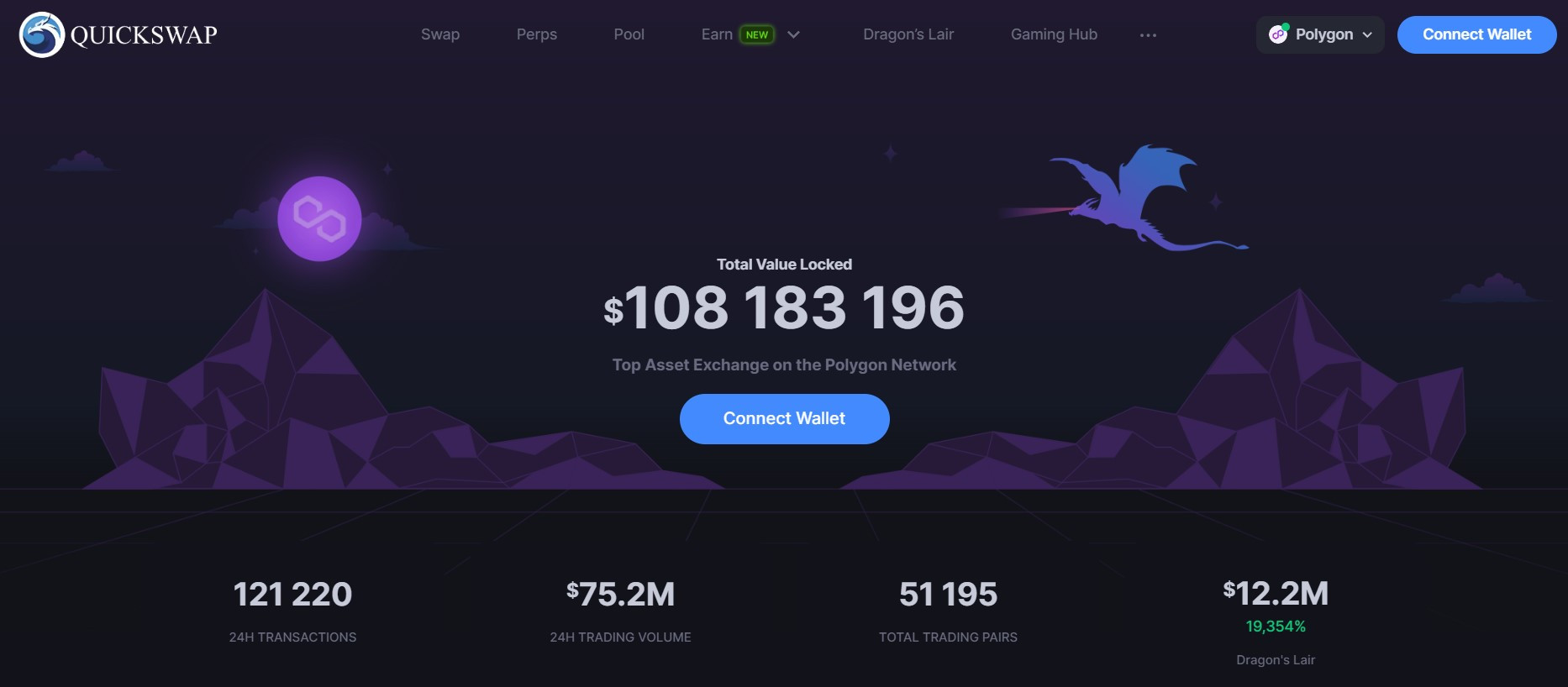

Quickswap

- Block chain: Polygon

- Type of exchange: AMM

- Trading pairs: 100+

- Features and capabilities: Margin trading

- Security: Smart contract approval

- Fees: 0.3%

Quickswap is a decentralized exchange that runs on the Polygon network. It is an AMM-based exchange that offers a wide range of trading pairs and low fees.

Raydium

- Block chain: Solana

- Type of exchange: AMM

- Trading pairs: 100+

- Features and capabilities: Margin trading

- Security: Smart contract approval

- Fees: 0.025%

Raydium is a decentralized exchange that runs on the Solana network. It is an AMM-based exchange that offers a wide range of trading pairs and low fees.

Conclusion

In this article, we reviewed the best decentralized exchanges based on a variety of factors. The best DEX for you will depend on your individual needs and preferences.

Factors to consider when choosing a DEX:

- The types of assets you want to trade: Some DEXs offer a wider range of assets than others.

- The features and benefits you are looking for: Some DEXs offer margin trading, perpetual contracts, or other features.

- The security and reputation of the DEX: It is important to choose a DEX that has a good security track record.

- The fees charged by the DEX: DEXs typically have lower fees than centralized exchanges.

DEX's FAQ

What wallets can I use with a DEX?

You can use any non-custodial cryptocurrency wallet with a DEX. Non-custodial wallets give you full control over your private keys, which means that you are responsible for the security of your funds. Some popular non-custodial wallets include:

- MetaMask

- Coinbase Wallet

- Trust Wallet

- Ledger Nano S

- Trezor

What are the fees associated with using a DEX?

DEXs typically charge a small fee for each trade. The fee amount varies depending on the DEX you are using. For example, Uniswap charges a 0.3% fee on each trade.

In addition to trading fees, you may also have to pay network fees. Network fees are paid to the miners who process and validate transactions on the blockchain. Network fees can vary depending on the blockchain and the current network congestion.

How can I reduce the fees associated with using a DEX?

- Use a DEX that offers lower trading fees.

- Trade during off-peak hours when network congestion is lower.

- Use a limit order to specify the maximum price you are willing to pay for a trade. This can help you to avoid paying higher fees due to slippage.

Is there anything else I should know about DEX fees?

It is important to note that DEX fees can vary depending on the market conditions. For example, if there is a lot of demand for a particular cryptocurrency, the trading fees may be higher.

It is also important to be aware of the network fees associated with using a DEX. Network fees can fluctuate depending on the blockchain and the current network congestion.

Overall, it is important to do your research and understand the fees associated with using a DEX before you start trading.

What are the advantages and disadvantages of decentralized exchanges (DEXs)?

Advantages:

- No central authority: No single entity controls your funds or transactions, reducing the risk of hacks or freezing.

- Greater access: Trade a wider range of cryptocurrencies, especially new and emerging tokens.

- Security: Transactions are stored on the blockchain, offering greater transparency and immutability.

- Privacy: Maintain control over your private keys and avoid KYC/AML requirements.

Disadvantages:

- Complexity: DEXs can be challenging to use for beginners due to their non-custodial nature and reliance on blockchain technology.

- Lower liquidity: Compared to centralized exchanges, DEXs may have less liquidity, leading to slippage and price volatility.

- Limited fiat support: Depositing and withdrawing fiat currencies can be difficult or unavailable on some DEXs.

- Technical risks: Smart contracts and protocols can have vulnerabilities, exposing users to potential exploits.

How do decentralized exchanges work?

DEXs operate through smart contracts, automated programs deployed on the blockchain. These contracts facilitate peer-to-peer trading by managing liquidity pools, where users deposit their cryptocurrencies to earn rewards and enable others to trade. Prices are determined algorithmically based on supply and demand within the pool.

What are the different types of decentralized exchanges?

- Automated Market Makers (AMMs): Most common type, using algorithms to set prices based on liquidity pools. Examples: Uniswap, SushiSwap.

- Order Book DEXs: Similar to centralized exchanges, but orders are stored on the blockchain in a decentralized manner. Example: Bisq.

- Local Exchange Trading Systems (LETS): Peer-to-peer exchanges focused on specific communities or regions.

What are the risks associated with using decentralized exchanges?

- User responsibility: You are solely responsible for managing your private keys and securing your wallet. Loss of keys can lead to permanent fund loss.

- Smart contract vulnerabilities: Exploits in smart contracts can lead to theft of funds. Careful research is crucial before using any DEX.

- Volatility: Cryptocurrencies are inherently volatile, and prices can fluctuate significantly, leading to potential losses.

- Liquidity risk: Low liquidity can lead to slippage and difficulty entering/exiting positions.

How to choose a decentralized exchange?

- Consider your experience level: Choose a beginner-friendly platform if you're new to DeFi.

- Supported tokens: Ensure the DEX trades the cryptocurrencies you want.

- Liquidity: Choose a platform with sufficient liquidity for your desired trading pairs.

- Fees: Compare transaction fees and gas costs for different platforms.

- Security: Research the platform's security track record and smart contract audits.

How to trade on a decentralized exchange?

- Connect your wallet: Use a compatible Web3 wallet like MetaMask or Coinbase Wallet.

- Choose your trading pair: Select the tokens you want to buy and sell.

- Set your trade: Specify the amount you want to trade and the desired price.

- Review and confirm: Review the transaction details and confirm the trade.

- Wait for execution: The DEX will match your order with available liquidity and execute the trade on the blockchain.

How to deposit and withdraw funds from a decentralized exchange?

- Deposit funds: Send the desired cryptocurrency from your wallet to the DEX address displayed for the chosen token.

- Withdraw funds: Provide the withdrawal address on your wallet and confirm the transaction. Remember to factor in gas fees for blockchain transactions.

Technical Challenges:

What are the main technical challenges faced by decentralized exchanges?

- Scalability: Blockchains have transaction throughput limitations, hindering DEX scalability. Layer 2 solutions and blockchain scaling advancements are being explored.

- Interoperability: Fragmented liquidity across blockchains can be addressed through cross-chain bridges and interoperability protocols.

- Security: Smart contract vulnerability exploits can lead to fund loss. Regular audits, penetration testing, and bug bounty programs are crucial.

- UI/UX: DEX interfaces can be complex for non-technical users. Improved UI/UX design and developer tools are needed for broader adoption.

User-friendliness:

How can decentralized exchanges be made more user-friendly?

- Simplified interfaces: Streamlined trading processes, guided tutorials, and fiat on-ramps can enhance accessibility.

- Improved wallet integration: Seamless integration with popular wallets and mobile apps can improve convenience.

- Educational resources: Comprehensive guides, FAQs, and community support can equip users with knowledge and confidence.

Regulatory Implications:

What are the regulatory implications of decentralized exchanges?

- Decentralized governance: Defining regulatory frameworks for platforms without central control presents challenges. Collaboration between regulators and the crypto community is needed.

- AML/KYC compliance: Balancing user privacy with measures to combat money laundering and terrorist financing is complex. Decentralized identity protocols could offer solutions.

- Taxation: Clarifying tax regulations for cryptocurrency transactions on DEXs can provide certainty for users and promote responsible reporting.

Financial Inclusion:

How can decentralized exchanges be used to improve financial inclusion?

- Unbanked populations: DEXs can offer financial services to those excluded from traditional banking systems, promoting financial empowerment.

- Microfinance and remittances: DEXs can enable microtransactions and facilitate cross-border remittances at lower costs.

- Community-driven lending and fundraising: DEXs can empower communities to create crowdfunding platforms and access lending services without intermediaries.

Reduced Financial Fraud:

How can decentralized exchanges be used to reduce financial fraud?

- Transparency: On-chain transactions recorded on the blockchain enhance transparency and reduce opportunities for fraudulent activities.

- Auditability: Smart contracts allow for public scrutiny and auditing, potentially deterring fraudulent behavior.

- Disintermediation: By removing intermediaries, DEXs can reduce points of vulnerability to fraud and financial manipulation.

Financial Transparency:

How can decentralized exchanges be used to promote financial transparency?

- Real-time data: The public nature of blockchain transactions facilitates real-time market data tracking and analysis, promoting transparency and trust.

- Reduced information asymmetry: Decentralized governance models and open-source protocols can decrease information asymmetry and empower users.

- Traceability: The immutability of blockchain records allows for tracing of funds and auditing of transactions, enhancing financial transparency.

New Financial Products and Services:

How can decentralized exchanges be used to create new financial products and services?

- Automated investment strategies: Smart contracts can be used to create automated investment strategies and portfolio management tools.

- Fractionalized ownership: DEXs can facilitate fractional ownership of real-world assets and collectibles, democratizing access to investment opportunities.

- Decentralized insurance: Peer-to-peer insurance protocols on DEXs could offer innovative and potentially more affordable insurance solutions.

Future and Impact of Decentralized Exchanges:

What is the future of decentralized exchanges (DEXs)?

The future of DEXs is full of potential, but uncertainty also remains. Here are some possible scenarios:

- Mass adoption: With improved user experience, scalability solutions, and clearer regulations, DEXs could become mainstream financial platforms, even rivalling traditional exchanges.

- Specialized niche: DEXs might serve as highly specialized platforms for specific asset classes or niche communities, complementing traditional finance for certain use cases.

- Hybrid model: A hybrid model could emerge, where traditional exchanges integrate DEX features and vice versa, blurring the lines between centralized and decentralized platforms.

How will decentralized exchanges impact the traditional financial system?

DEXs could potentially impact traditional finance in various ways:

- Increased competition: DEXs can offer lower fees and greater control over assets, challenging traditional exchanges' dominance and pushing them to improve.

- Democratization of finance: DEXs can empower individuals with direct access to financial markets, bypassing intermediaries and potentially reducing wealth inequality.

- Innovation and new products: DEXs can foster innovation in financial products and services, such as DeFi applications and novel investment instruments.

What are the ethical implications of decentralized exchanges?

DEXs raise several ethical concerns to consider:

- Accessibility and inequality: The complexity of DEXs could exacerbate existing financial inequalities if access is limited to tech-savvy users.

- Regulatory gap: Lack of clear regulations could create space for illegal activities and consumer protection issues.

- Environmental impact: Blockchain technology's energy consumption raises concerns about DEXs' sustainability.

Overall, the future of DEXs is brimming with possibilities, but navigating the ethical and regulatory landscape will be crucial for their long-term success and positive impact on the financial system. While they may not completely replace traditional finance, DEXs have the potential to democratize access, foster innovation, and reshape the financial landscape in the years to come.