Short-Term Bitcoin Holders Take Profits as Long-Term Investors Remain Steadfast

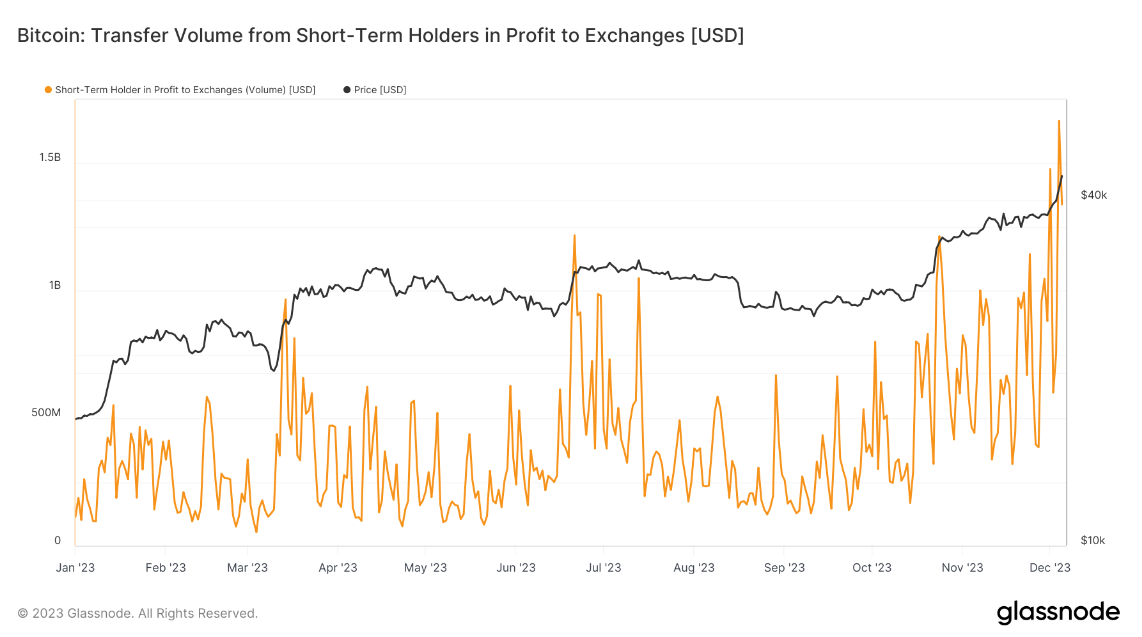

Recent analysis by CryptoSlate has revealed a notable trend among short-term Bitcoin holders. On December 1, a record-breaking $1.7 billion worth of Bitcoin was sent to exchanges, indicating that short-term holders were cashing in on profits. This coincided with a 13% surge in Bitcoin's price since then.

The trend continued on December 5 when Bitcoin surpassed the $44,000 mark, with an additional $1.3 billion worth of coins sent to exchanges. This suggests that short-term holders may have collectively profited by approximately $3 billion over a two-day period.

Interestingly, long-term Bitcoin holders, those who have held their coins for more than 155 days, have also begun to realize profits. In the past two days, they have collectively sold around $225 million worth of Bitcoin. While this figure is significant compared to previous trends in 2023, it is important to note that long-term holders continue to hold a substantial amount of Bitcoin, indicating their unwavering confidence in the asset's long-term value.

Key Takeaways:

- Short-term Bitcoin holders have taken profits, sending $3 billion worth of coins to exchanges in just two days.

- Long-term Bitcoin holders have also begun to realize profits, but they continue to hold a significant portion of the asset's supply.

- The recent surge in Bitcoin's price may have prompted some investors to take profits, but overall sentiment remains bullish.