JPMorgan and Goldman Sachs May Become Authorized Participants In BTC Spot ETFs

Crypto asset manager Grayscale Investments is in talks with JPMorgan and Goldman Sachs to bring these banks on board as authorized participants in a spot BTC ETF.

Authorized participants are firms that have the authority to create and redeem shares of a fund. They play a critical role as they ensure that the ETF's share price matches the fund's underlying assets. In addition, authorized participants also represent a key source of liquidity.

Grayscale previously filed an updated Form S-3 filing with the SEC on Jan. 2. In it, the company did not list any authorized participants.

The SEC's decision on applications to launch spot BTC ETFs is expected to be made in the coming weeks.

Bitcoin fell 9% after Matrixport report

Yesterday, January 3, the price of bitcoin collapsed by 9% amid a report from investment firm Matrixport. In the report, analysts said that the SEC is likely to reject all applications to launch spot BTC ETFs in the US.

As a result of the panic sell-off, the volume of liquidated positions in the bitcoin market surpassed the $500 million mark.

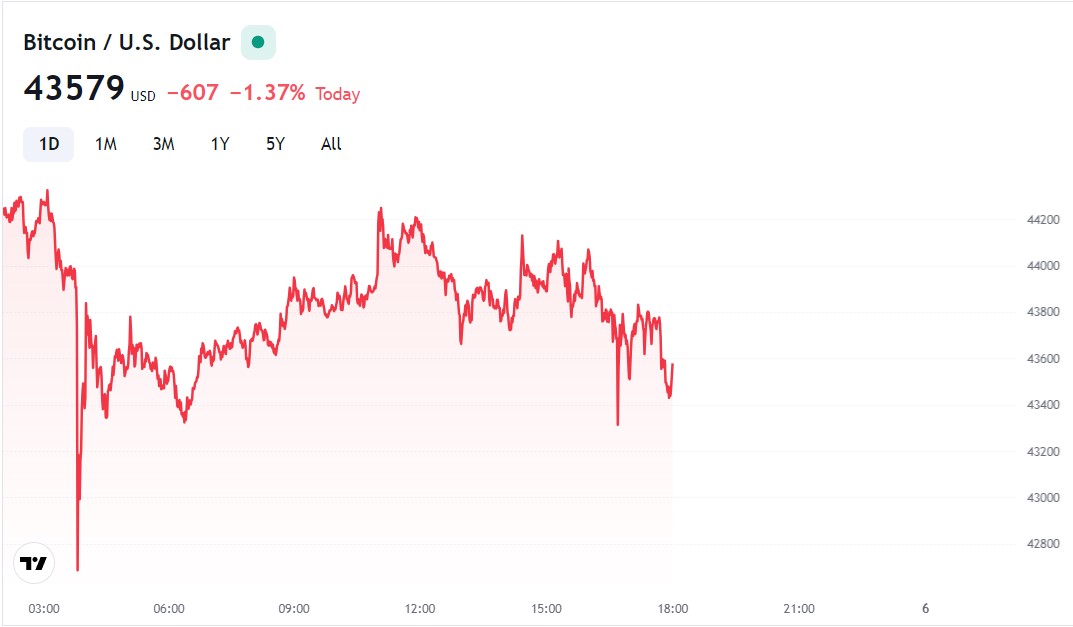

Bitcoin price now

Amid the Matrixport scandal, bitcoin's low was recorded at $40,813, with a high of $45,503. According to CoinGecko, at the time of writing, BTC is trading at $42,933. Over the past 24 hours, the value of the asset has fallen by 4.9%.

The market capitalization of the first cryptocurrency has decreased by 4.94% over the past 24 hours. The daily trading volume increased by 57.07% to $47.374 million, according to CoinMarketCap.