JPMorgan Adjusts Ratings and Targets for Bitcoin Mining Stocks, Maintains Optimism on Spot ETFs

Wall Street giant JPMorgan has reviewed its price targets and ratings for several Bitcoin mining companies, factoring in recent price surges and network developments.

Here's a breakdown of the key updates:

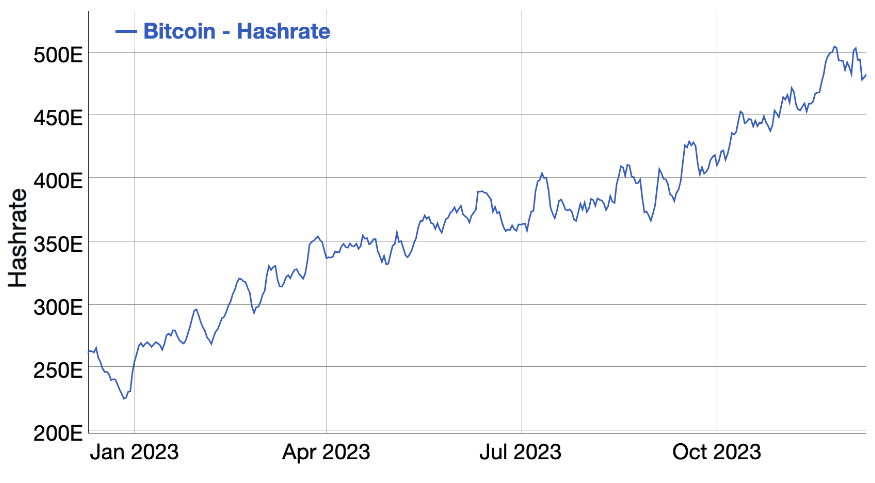

- Bitcoin Price and Hashrate Assumptions: JPMorgan increased its anticipated spot BTC price to $44,000 and network hashrate to 485 EH/s, acknowledging the recent market trends.

- CleanSpark: Downgraded to "Neutral" from "Overweight" with a reduced price target of $8. This reflects the company's significant stock price increase (over 130%) in the past month, reaching what JPMorgan deems fair valuation.

- Riot Platforms: Upgraded to "Neutral" from "Underweight" with an elevated price target of $12. This indicates a shift in perspective from the bank.

- Iris Energy: Maintains its "Overweight" rating and remains the top pick in the sector. JPMorgan further boosted its price target to $9.50.

Looking beyond individual companies, JPMorgan remains optimistic about the potential approval of spot Bitcoin ETFs in 2023. Analyst Nikolaos Panigirtzoglou previously expressed confidence in the SEC's eventual approval and warned against potential legal challenges if rejected.

This news indicates a cautious yet optimistic outlook on the Bitcoin mining industry amidst recent market developments. While individual company assessments vary, JPMorgan's overall perspective on the sector remains positive.

Author: Denis Tabyrtsa