BlackRock Contemplates Expanding Bitcoin Holdings Amidst Bullish Market Sentiment

BlackRock, the largest asset manager globally, is weighing the possibility of increasing its exposure to Bitcoin, anticipating considerable potential for growth in the cryptocurrency market.

In a recent interview with The Wall Street Journal, Rick Rieder, BlackRock’s Chief Investment Officer of global fixed income, acknowledged the firm's current limited investment in Bitcoin. Rieder hinted that as confidence in Bitcoin continues to rise among investors, BlackRock may reconsider its position and allocate a more significant portion of its investment portfolios to the cryptocurrency.

Rieder expressed, "It remains to be seen whether Bitcoin will play a significant role in our asset allocation strategy. However, as time progresses, we anticipate a growing comfort level with the asset."

He stressed the importance of offering accessible avenues for investors to engage with Bitcoin, whether through ownership, trading, or liquidation. Rieder believes that as more individuals and institutions embrace Bitcoin, its potential for substantial growth will become increasingly evident.

"While more investors adopt Bitcoin as an asset, we see genuine upside potential," he added.

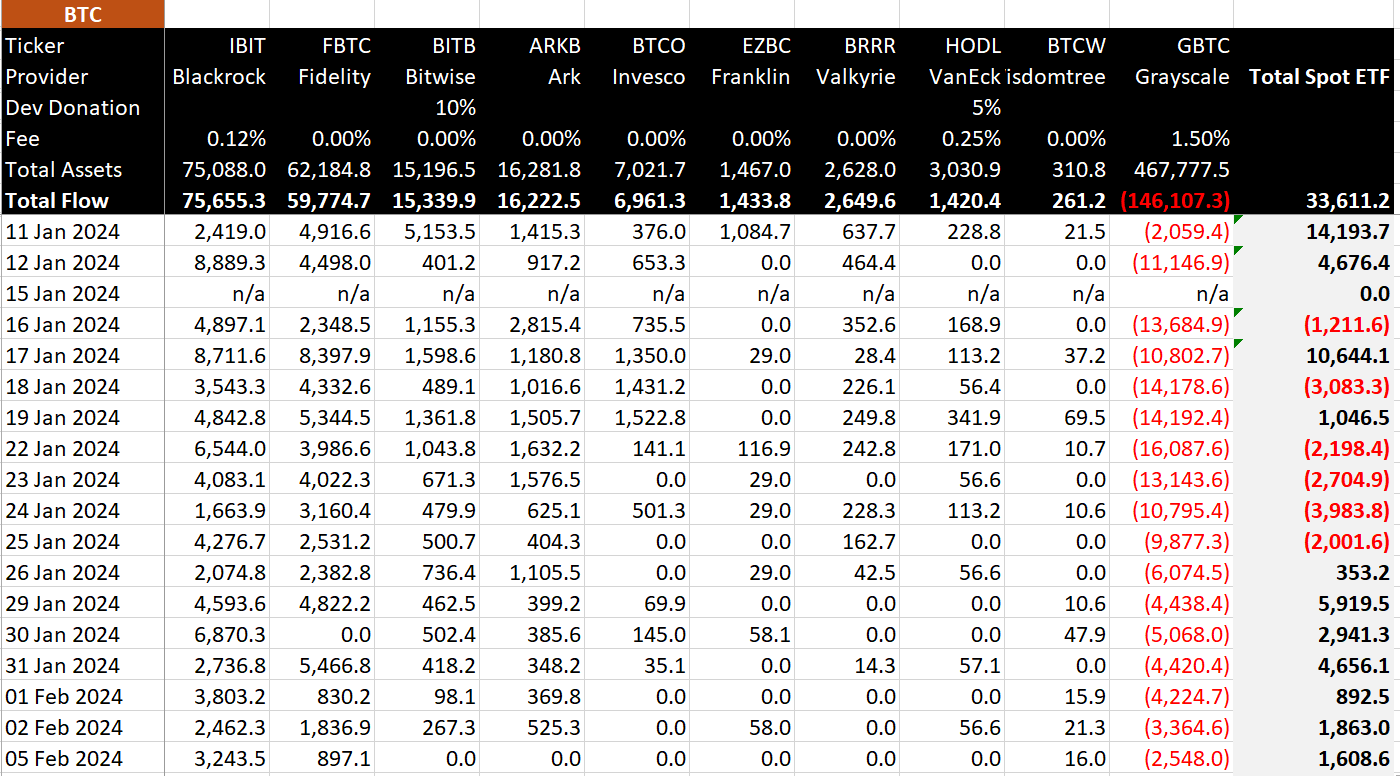

BlackRock's contemplation of expanding its Bitcoin holdings aligns with a broader trend of increasing interest in cryptocurrency investment options. Notably, BlackRock has already taken proactive steps in this direction by launching a spot Bitcoin ETF Fund, which currently manages over $3 billion in digital currency assets. Following the approval of Bitcoin exchange-traded funds (ETFs) last month, BlackRock and Fidelity have both seen significant inflows, collectively attracting $6.39 billion in Bitcoin investments.

In contrast, the Grayscale Bitcoin Trust ETF (GBTC) has experienced substantial outflows, totaling just over $6.8 billion since the approval of spot ETFs.

Bitcoin witnessed a significant rally in late December, driven by speculation surrounding the potential approval of a spot ETF by BlackRock. Larry Fink, the CEO of BlackRock, attributed this surge to a shift in investor behavior, stating, "The surge is likely tied to investors seeking refuge in 'quality' assets amidst ongoing geopolitical tensions."

Fink also expressed optimism about the growing adoption of Bitcoin, highlighting that BlackRock's entry into the cryptocurrency market reflects its commitment to providing accessible investment options for clients.

"We believe in democratizing investing. Our efforts to transform investments through ETFs are just the beginning," Fink affirmed.