Bitcoin Hashrate Climbs Skyward: Miners Face Profit Squeeze, Investors Eye Halving

A Golden Moment for Security, a Cloudy Day for Miners: Bitcoin's hashrate just reached an all-time high of 544 EH/s, showcasing increased network security but bringing fresh hardship to miners battling plummeting profitability.

Record-Breaking Climb: 2023 has witnessed a phenomenal 130% surge in Bitcoin's hashrate, more than doubling since January. This rise coincides with a remarkable 150% price increase for the digital gold.

China's Ban a Distant Blip: The 2021 China mining ban, once seen as a potential crippling blow, appears to have barely affected the network's resilience. Will Clemente, a respected analyst, reinforces this notion, calling the ban "a blip" in Bitcoin's unwavering journey.

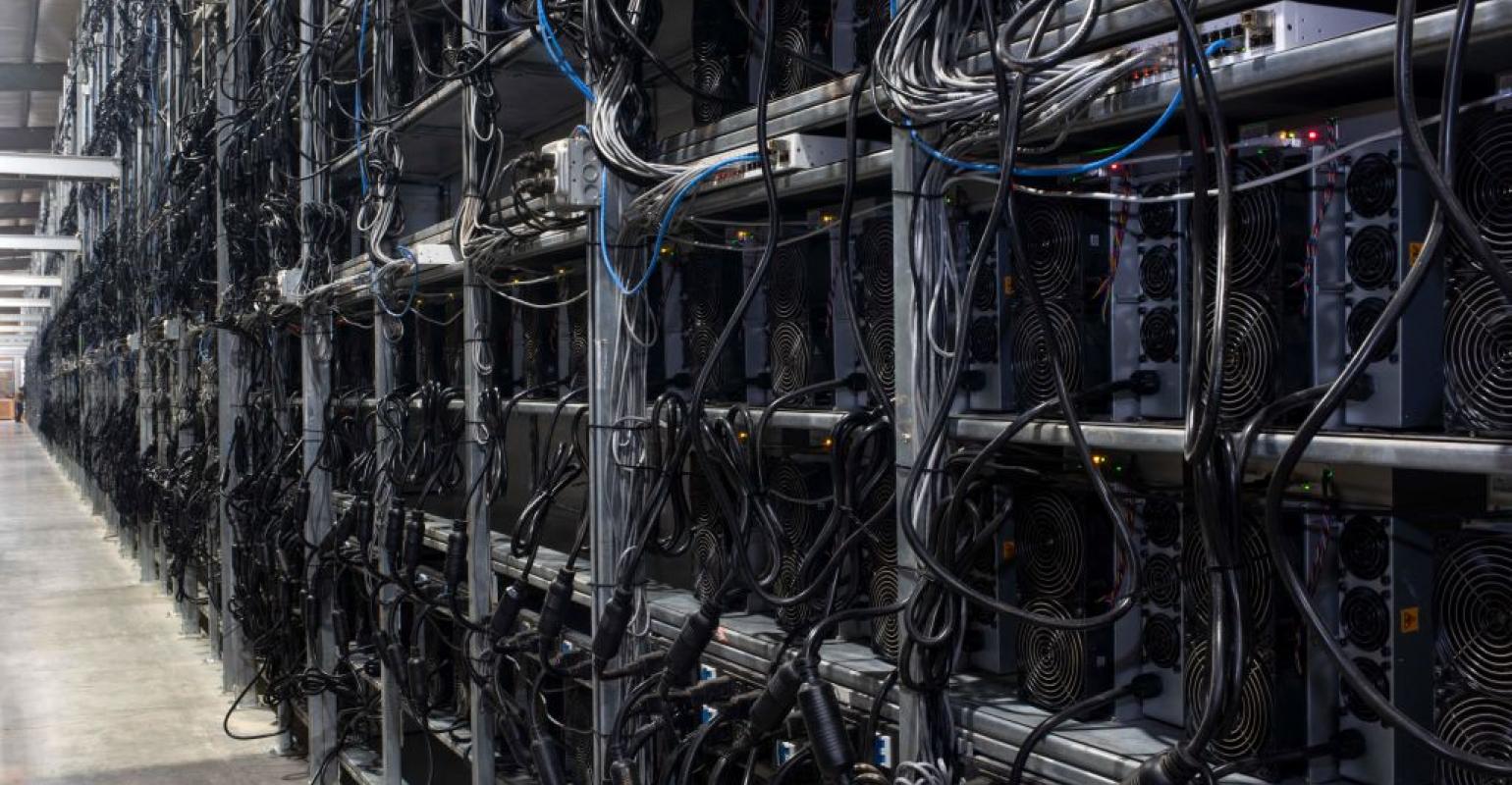

The Double-Edged Sword of High Hashrate: While a robust hashrate bolsters security and price models, it presents a harsh reality for individual miners. Increased competition means harder block rewards, demanding higher operational costs.

Profitability Crunch Underway: Hash price, a key indicator of mining profitability, has plunged 34% since its December peak. This decline stems from several factors, including:

- Cooling Hype: The initial excitement surrounding BRC-20 ordinal inscriptions has subsided, reducing transaction fees and miner revenue.

Persistent Mempool Congestion: Backlogged transactions in Bitcoin's mempools have kept transaction fees elevated for nearly a year, further squeezing miner margins. - Upcoming Halving: A Looming Specter: Investors are keeping a close eye on the 2024 Bitcoin halving, where miner rewards will be slashed in half. This event historically tightens supply and often paves the way for price appreciation, but its impact can be gradual and unpredictable.

A Balancing Act: Soaring hashrate strengthens Bitcoin's security but throws profitability into limbo. Miners navigate a challenging landscape, while investors anticipate the potential price ripple effects of the upcoming halving. Only time will tell how this intricate dance will unfold for Bitcoin's network and its stakeholders.

Key Takeaways:

Positive:

- Bitcoin's network security is at an all-time high due to record-breaking hashrate.

- Bitcoin's price has surged 150% this year, indicating strong market demand.

- The China mining ban proved a minor obstacle, showcasing Bitcoin's resilience.

- Historically, Bitcoin halvings have led to price increases in the long run.

Negative:

- Miners are facing declining profitability due to increased competition and lower transaction fees.

- Congestion in Bitcoin's mempools is pushing up transaction costs for users.

- The upcoming halving in 2024 will further cut miner rewards, putting profitability under further pressure.

- The impact of the halving on price is uncertain and may take time to materialize.

Overall:

- Bitcoin's fundamentals are strong, with robust security and sustained demand.

- Miners are facing near-term challenges related to profitability.

- Investors should anticipate potential price adjustments due to the upcoming halving.