JPMorgan: Bitcoin Rally Is Fueled By Speculators, Not A Transition From Gold

JPMorgan analysts, in a report published by The Block , argue that the recent rise in Bitcoin is not due to a transition from gold, but to speculative investments.

Retail and speculative institutional investors are simultaneously buying gold and Bitcoin futures, which experts say is the main driver of the rally.

Spot Bitcoin ETFs have seen significant inflows since early January, while gold ETFs have experienced a decline. However, JPMorgan does not consider this to be evidence of investors shifting from traditional assets to cryptocurrency.

“Speculative institutional investors such as hedge funds and CTAs are also likely fueling the rally by buying gold and Bitcoin futures since February, perhaps even more so than retail market participants,” the analysts noted.

JPMorgan futures indicators show a sharp increase in positions since February, with Bitcoin recording $7 billion inflows and gold $30 billion.

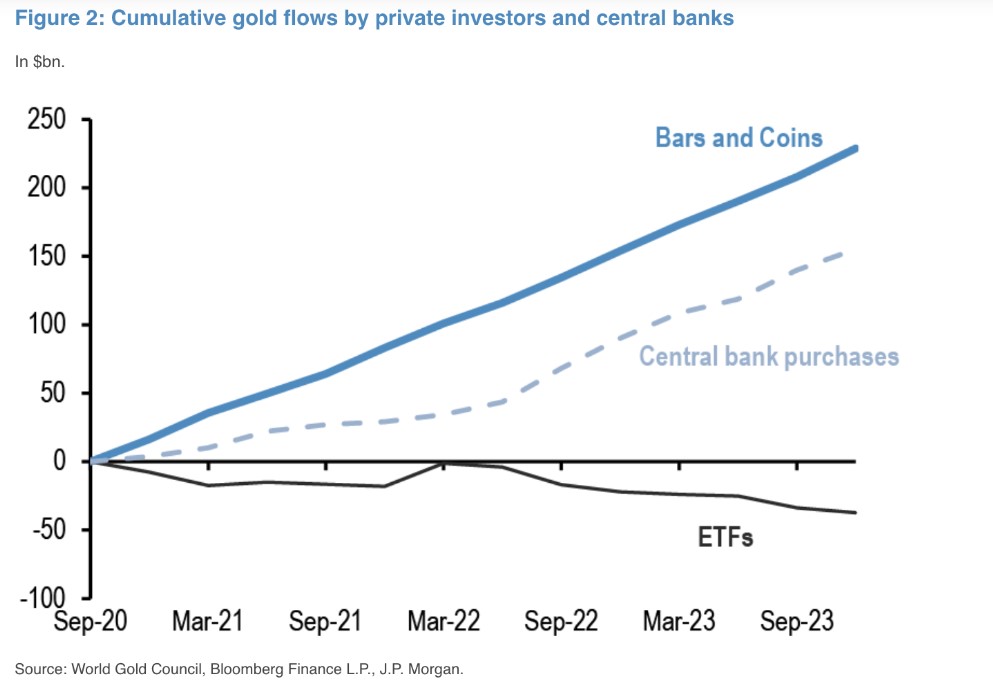

Analysts stress that the outflow from gold ETFs is not a new phenomenon and is not related to the launch of Bitcoin funds. This trend has been observed for the past four years since the coronavirus pandemic.

“The outflow does not reflect a dislike of gold by retail investors, but rather a shift from gold ETFs to physical bars and coins,” JPMorgan said.

Regarding Bitcoin ETFs, researchers have noticed a rotational transfer of capital from crypto exchanges to traditional trading platforms. Since January, the cumulative outflow of Bitcoin from CEX has amounted to about $7 billion.

“In other words, it is more likely that net retail investor inflows into newly created ETFs will be closer to $2 billion rather than $9 billion,” the report said.

JPMorgan also criticizes MicroStrategy for its leveraged purchases of Bitcoin. This adds leverage and froth to the current cryptocurrency rally and raises the risk of deeper deleveraging in the event of a potential downturn in the future, analysts say.

“MicroStrategy's debt-financed Bitcoin purchases add leverage and froth to the current cryptocurrency rally and raise the risk of deeper deleveraging in the event of a potential future downturn,” JPMorgan concluded.